Our team is ready to learn about your business and guide you to the right solution. To ensure that everyone is on the same page, try writing down your accounting routine in a procedures manual and use it to train your staff or as a self-reference. Even if you decide to outsource bookkeeping, it’s important to discuss which practices work best for your business. This happens when you issue a refund, apply a discount, or adjust for an error because you’re taking from your total income.

Free Course: Understanding Financial Statements

Angela Boxwell, MAAT, is an accounting and finance expert with over 30 years of experience. She founded Business Accounting Basics, where she provides free advice and resources to small businesses. Accounts payable can be managed by ensuring that payments are made on time. This helps to avoid late fees and penalties, and it also helps to maintain good relationships with suppliers.

How to do a balance sheet

If you want to learn how debit and credit entries are used to generate financial statements at the end of the year, head over to our guide on the accounting cycle. Most accountants, bookkeepers, and accounting software platforms use the double-entry method for their accounting. Under this system, your entire business is organized into individual accounts. Think of these as individual buckets full of money representing each aspect of your company. Credits boost your revenue accounts since they represent income your business has earned.

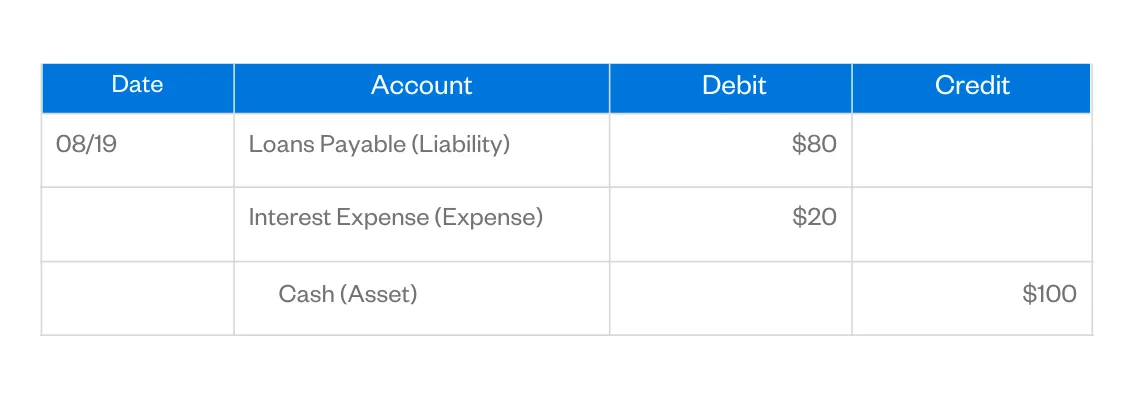

Debits and credits in action

Debits and credits are equal but opposite entries in your books. If a debit increases an account, you must decrease the opposite account with a credit. If revenues (credits) exceed expenses (debits) then net income is positive and a credit balance.

Prompt payment of invoices ensures that a company has the cash to pay its bills when they are due. In addition, accounts receivable can be managed by offering discounts for early payments, encouraging customers to pay their invoices quickly. If a company buys supplies for cash, its Supplies account and its Cash account will be affected.

Now it’s time to update his company’s online accounting information. Perhaps you need help balancing your credits and debits on your income statement. At the end of a period, a trial balance report will be produced; this will include all the debits and credits from the general ledger, and both sides of the report will balance.

- Part of your role as a business is recording transactions in your small business accounting books.

- This means that the total debits must equal the total credits.

- By mastering the concepts outlined in this guide, businesses can effectively record transactions, analyze financial performance, and make informed decisions.

- When a company acquires a new asset, it records the asset in an asset account.

- The AI algorithm continuously learns through a feedback loop which, in turn, reduces false anomalies.

Deskera is an intuitive, super easy-to-use software that automates your entire double-entry bookkeeping, in a matter of seconds. On February 2nd, the company collected $2,350 for advertising services. In this case, we’re crediting a bucket, but the value of the bucket is increasing. That’s because the bucket keeps track of a debt, and the debt is going up in this case.

However, back when people kept their accounting records in paper ledgers, they would write out transactions, always placing debits on the left and credits on the right. Equity accounts like retained earnings and common stock also have a credit balances. This means that equity accounts are increased by credits and decreased by debits.

Double entry bookkeeping ensures accuracy in accounting processes. A debit is an accounting entry that increases assets and expenses and decreases liabilities, equity, and revenue. Recorded on the left side of a general ledger, debits reflect the inflow of value into a business, impacting how do i file for free as a college student the balance of various accounts. Both cash and accounts receivable are asset accounts, cash is increased with a debit and the credit decreases accounts receivable. The balance sheet formula remains in balance because assets are increased and decreased by the same dollar amount.

In accounting, account balances are adjusted by recording transactions. Transactions always include debits and credits, and the debits and credits must always be equal for the transaction to balance. If a transaction didn’t balance, then the balance sheet would no longer balance, and that’s a big problem. In financial accounting, there are rules set in place that ensure that every financial transaction has equal amounts of debits and credits.

Debit always goes on the left side of your journal entry, and credit goes on the right. In double-entry bookkeeping, the left and right sides (debits and credits) must always stay in balance. This might happen if you adjust or reverse the expenses you previously recorded. For example, For example, let’s say you were charged for a service you didn’t end up using, and the vendor issued a refund. You would credit the expense account for that service to reflect the refunded amount.